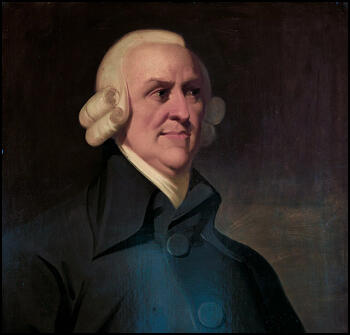

Adam Smith

Adam Smith was born in Kirkcaldy, Scotland in June, 1723. He was educated at Glasgow University and Oxford University. In 1751 he was appointed as professor of logic at Glasgow and of moral philosophy the following year. His lectures covered the fields of ethics, rhetoric, jurisprudence and political economy.

Smith formed a close friendship with the moral philosopher, David Hume. In 1759 Smith published a Theory of Moral Sentiments, based on the ideas developed by Hume. His book attempted to explain how human communication depends on sympathy between the individual and other members of society.

Smith was appointed as tutor to the Duke of Buccleuch in 1763. The two men lived in France but when Buccleuch died in Paris in 1766 Smith returned to London and the following year he was elected to the Royal Society.

Smith wrote a moving account of David Hume's death in 1776. Later that year he published his best-known work, Inquiry into the Nature and Causes of the Wealth of Nations. The book was an attempt to trace the historical development of industry and commerce in Europe. Smith examined the consequences of economic freedom and argued that it was the division of labour, rather than land or money, that was the main ingredient of economic growth. As he explained: "Every man is rich or poor according to the degree in which he can afford to enjoy the necessaries, conveniencies, and amusements of human life. But after the division of labour has once thoroughly taken place, it is but a very small part of these with which a man's own labour can supply him. The far greater part of them he must derive from the labour of other people, and he must be rich or poor according to the quantity of that labour which he can command, or which he can afford to purchase."

Adam Smith pointed out the dangers of a system that allowed individuals to pursue individual self-interest at the deteriment of the rest of society. He warned against the establishment of monopolies. "A monopoly granted either to an individual or to a trading company has the same effect as a secret in trade or manufactures. The monopolists, by keeping the market constantly understocked, by never fully supplying the effectual demand, sell their commodities much above the natural price, and raise their emoluments, whether they consist in wages or profit, greatly above their natural rate."

Smith went onto argue: "People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public, or in some contrivance to raise prices. It is impossible indeed to prevent such meetings, by any law which either could be executed, or would be consistent with liberty and justice. But though the law cannot hinder people of the same trade from sometimes assembling together, it ought to do nothing to facilitate such assemblies; much less to render them necessary."

Smith argued that capitalism results in inequality. For example, he wrote about the impact poverty had on the lives of the labouring class: "It is not uncommon... in the Highlands of Scotland for a mother who has borne twenty children not to have two alive... In some places one half the children born die before they are four years of age; in many places before they are seven; and in almost all places before they are nine or ten. This great mortality, however, will every where be found chiefly among the children of the common people, who cannot afford to tend them with the same care as those of better station."

To protect the poor Smith argued for government intervention: ""The man whose whole life is spent in performing a few simple operations, of which the effects are perhaps always the same, or very nearly the same, has no occasion to exert his understanding or to exercise his invention in finding out expedients for removing difficulties which never occur. He naturally loses, therefore, the habit of such exertion, and generally becomes as stupid and ignorant as it is possible for a human creature to become. The torpor of his mind renders him not only incapable of relishing or bearing a part in any rational conversation, but of conceiving any generous, noble, or tender sentiment, and consequently of forming any just judgment concerning many even of the ordinary duties of private life... But in every improved and civilized society this is the state into which the labouring poor, that is, the great body of the people, must necessarily fall, unless government takes some pains to prevent it."

In the Inquiry into the Nature and Causes of the Wealth of Nations Smith argues that progressive taxation is a vital ingredient in the creation of a fair society: "The subjects of every state ought to contribute towards the support of the government, as nearly as possible, in proportion to their respective abilities; that is, in proportion to the revenue which they respectively enjoy under the protection of the state. The expense of government to the individuals of a great nation is like the expense of management to the joint tenants of a great estate, who are all obliged to contribute in proportion to their respective interests in the estate. In the observation or neglect of this maxim consists what is called the equality or inequality of taxation.

It has been wrongly argued that Inquiry into the Nature and Causes of the Wealth of Nations was the world's first book on economics. In fact, Anders Chydenius, a Swedish priest and economist published The National Gain in 1765. Although both men covered similar ground, Smith's book changed the way people approached the subject of economics.

In 1777 he was appointed commissioner of customs in Scotland and went to live with his mother in Edinburgh. In 1787 he was elected lord rector of Glasgow University.

Adam Smith died in Edinburgh on 17th July, 1790.

Primary Sources

(1) Adam Smith, Inquiry into the Nature and Causes of the Wealth of Nations (1776)

Every man is rich or poor according to the degree in which he can afford to enjoy the necessaries, conveniencies, and amusements of human life. But after the division of labour has once thoroughly taken place, it is but a very small part of these with which a man's own labour can supply him. The far greater part of them he must derive from the labour of other people, and he must be rich or poor according to the quantity of that labour which he can command, or which he can afford to purchase. The value of any commodity, therefore, to the person who possesses it, and who means not to use or consume it himself, but to exchange it for other commodities, is equal to the quantity of labour which it enables him to purchase or command. Labour, therefore, is the real measure of the exchangeable value of all commodities. The real price of every thing, what every thing really costs to the man who wants to acquire it, is the toil and trouble of acquiring it.

(2) Adam Smith, Inquiry into the Nature and Causes of the Wealth of Nations (1776)

A monopoly granted either to an individual or to a trading company has the same effect as a secret in trade or manufactures. The monopolists, by keeping the market constantly understocked, by never fully supplying the effectual demand, sell their commodities much above the natural price, and raise their emoluments, whether they consist in wages or profit, greatly above their natural rate. The price of monopoly is upon every occasion the highest which can be got. The natural price, or the price of free competition, on the contrary, is the lowest which can be taken, not upon every occasion, indeed, but for any considerable time together. The one is upon every occasion the highest which can be squeezed out of the buyers, or which, it is supposed, they will consent to give: the other is the lowest which the sellers can commonly afford to take, and at the same time continue their business.

(3) Adam Smith, Inquiry into the Nature and Causes of the Wealth of Nations (1776)

People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public, or in some contrivance to raise prices. It is impossible indeed to prevent such meetings, by any law which either could be executed, or would be consistent with liberty and justice. But though the law cannot hinder people of the same trade from sometimes assembling together, it ought to do nothing to facilitate such assemblies; much less to render them necessary.

(4) Adam Smith, Inquiry into the Nature and Causes of the Wealth of Nations (1776)

The subjects of every state ought to contribute towards the support of the government, as nearly as possible, in proportion to their respective abilities; that is, in proportion to the revenue which they respectively enjoy under the protection of the state. The expense of government to the individuals of a great nation is like the expense of management to the joint tenants of a great estate, who are all obliged to contribute in proportion to their respective interests in the estate. In the observation or neglect of this maxim consists what is called the equality or inequality of taxation.

(5) Adam Smith, Inquiry into the Nature and Causes of the Wealth of Nations (1776)

The necessaries of life occasion the great expense of the poor. They find it difficult to get food, and the greater part of their little revenue is spent in getting it. The luxuries and vanities of life occasion the principal expense of the rich, and a magnificent house embellishes and sets off to the best advantage all the other luxuries and vanities which they possess. A tax upon house-rents, therefore, would in general fall heaviest upon the rich; and in this sort of inequality there would not, perhaps, be anything very unreasonable. It is not very unreasonable that the rich should contribute to the public expense, not only in proportion to their revenue, but something more than in that proportion.

(6) Adam Smith, Inquiry into the Nature and Causes of the Wealth of Nations (1776)

The man whose whole life is spent in performing a few simple operations, of which the effects are perhaps always the same, or very nearly the same, has no occasion to exert his understanding or to exercise his invention in finding out expedients for removing difficulties which never occur. He naturally loses, therefore, the habit of such exertion, and generally becomes as stupid and ignorant as it is possible for a human creature to become. The torpor of his mind renders him not only incapable of relishing or bearing a part in any rational conversation, but of conceiving any generous, noble, or tender sentiment, and consequently of forming any just judgment concerning many even of the ordinary duties of private life... But in every improved and civilized society this is the state into which the labouring poor, that is, the great body of the people, must necessarily fall, unless government takes some pains to prevent it.